Customer Profile

Federal Bank Limited (www.federal-bank.com) (NSE: FEDERALBNK, BSE: 500469, LSE: FEDS) is a major commercial bank listed on the Bombay and London stock exchanges and is headquartered in India. As of July 2012, it had 1000 branches spread across 24 states in India and 1029 ATMs around the country (across 108 metro centers, 224 urban centers, 384 semi-urban locations and 87 rural areas). Federal Bank, with its wide range of products and services, is a financial supermarket providing banking services, e-trading (Fed e-trade), foreign currency, internet banking (FedNet) and mobile banking (Fedmobile) among others.

The bank has also recently taken over the management of the World Exchange Center in Bahrain and is a major player catering to the large ex-pat population in UAE for deposits and foreign currency remittance services.

Business Problem

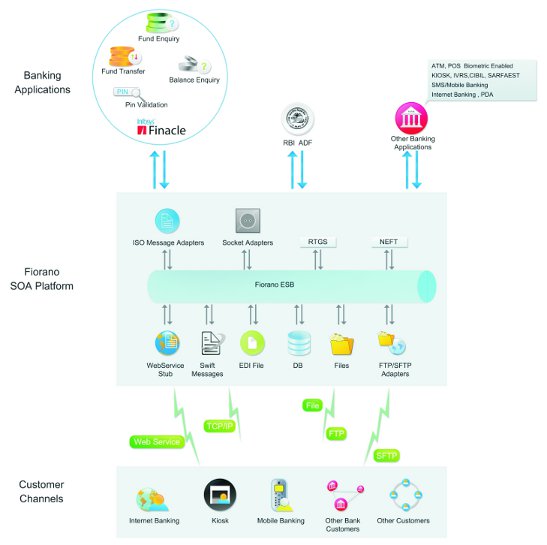

Federal Bank is using over 30 retail banking related applications from various vendors including Infosys Core banking platform FINACLE running on mixture of hardware including IBM AIX servers. As part of their expansion plans to increase the number of value added services to its customers, the Bank wanted to provide near real-time availability of foreign exchange remittances through SWIFT. In addition they had ambitious plans to extend their offering to build a multichannel payment gateway, expand their kiosk facilities and ATM network.

Their IT team realized that integration with multiple partners of SWIFT would require monumental investments in hardware, software and consulting efforts, putting their entire project behind schedule. The point to point nature of connections between these different applications would make the scalability and management of such a system a challenge and introduce multiple security vulnerabilities. Such a system would fall short of enterprise performance, reliability, scalability and affordability goals of the Bank.

- Time to Market for new Services

Delivering new services to market as fast as they wanted was an immediate goal. Integration with multiple partners in the current system would take months to implement and deploy. Software asset reuse would be severely limited, adding a layer of costs and increased time to market. - Reliability & Security challenges

Implementing a point to point type of network as many other banks had chosen would expose their network to multiple points of vulnerability and in the long term the rigidity of the system could become its Achilles heel, undermining the Bank's competitiveness in a rapidly changing environment - High Total cost of ownership

Federal Bank measured their return on investment along two vectors-direct costs & indirect benefits. While the requirement to add more hardware to accommodate newer functionality increased direct costs, meeting customer requirements and attending to system downtimes added to indirect costs and time overruns.

Solution Selection

At this point Federal Bank's IT team decided that the best long term solution was to revisit the architectural blue print of their Enterprise middleware infrastructure. After extended research their team decided on implementing an Enterprise Service Bus architecture. An ESB would allow reuse, rapid connectivity to partners and third parties across heterogeneous data formats and hardware.

Given the competitive nature of the industry and the increasing demands of the customer base for real-time banking with availability through multiple channels, they decided the ESB would give them the competitive edge and put in place a flexible and agile IT infrastructure that could respond quickly and effectively to growing business demands of a banking conglomerate like Federal Bank.

As they worked through a POC scenario, the team found several operating advantages which came primarily from the architectural uniqueness of the Fiorano ESB product as compared to other solutions in the market:

- Ease of use

Whereas traditional large stack solutions took several weeks to install and configure with complex pre-requisites, Fiorano ESB could be installed on a simple i3 core laptop in under 5 minutes. With the Fiorano Studio, changing or enabling new services was just a simple-drag-and-drop routine. There was minimal requirement for complex coding. - Significantly lower learning curve

Fiorano ESB offered a lower learning curve; whereas it would take a new software engineer almost 6 months to get productive on other systems, a new un-trained resource could learn and become part of the live Project team with Fiorano in just a week. - Transaction speed and Scalability

With the peer-to-peer architecture of the Fiorano product, near linear scalability was possible. Customers that earlier had to wait 24-48 hours for credits could now have their transfers available in under 60 seconds - Reliability

Absence of a single point of failure made the system inherently more robust and able to meet the Bank's high transactional volume and stress without fear of breakdowns. - High Availability

Software based high availability in Fiorano lowered the required investments in hardware as compared to competing solutions. - Error handling

Errors could be quickly identified, isolated and dealt with swiftly minimizing and sometime completely obviating any system downtime at all.

On a detailed evaluation they concluded that many of the offerings from traditional large stack vendors, though apparently feature rich, were not as simple and cohesive an ESB product. Implementation and deployment would necessarily require custom coding and extensive use of consulting services leading to a high cost structure.

After conducting a rigorous Proof-of-concept, the Architectural and IT team at Federal Bank picked Fiorano as the preferred solution that met all their criteria.

Benefits

While many of the benefits of the Fiorano ESB solution will be achieved over multiple projects over a period giving an ongoing ROI, the following are among the main benefits of this solution:

- Significantly improved Customer response levels:

Delivery of financial services today demands real-time event processing, one of Fiorano ESB's key strengths. The Federal Bank IT team plans to use the ESB to implement its SWIFT integration project immediately followed by its multichannel integration projected to be completed by March 2013. - Enabled rapid addition of new revenue channels:

New business flows can be implemented 50% faster with Fiorano ESB allowing delivery of new services as fast as the business requires and meet the Bank's stringent ROI objectives. The Bank hopes to put in place myriad value added services through multiple delivery channels including ATMs, kiosks, hand-held devices, mobile and internet. Fiorano's architecture supports incremental implementation. Therefore, deployments can be more modular and standardized, and less risky and less expensive. - Improved profitability of existing channels:

Business flows can be modified dynamically (i.e. changes to the flow do not require the flow to be stopped & redeployed), which is necessary for mission-critical, 24x7 environments. - Faster response to internal business needs:

Automatically configuring the underlying middleware allows the logical process design to be mapped directly to physical services distributed across the ESB, empowering non-technical business-users to compose, deploy, and modify event-driven business processes. - Implement Central bank regulatory requirements within

stipulated time frames:

Going forward the ESB may also be leveraged in managing data for compliance of Central bank (viz. the Reserve Bank of India) regulations and reporting requirements.

About Fiorano Software

Founded in 1995, Silicon Valley based Fiorano is a California Corporation with proven leadership in enterprise middleware and peer-to-peer distributed systems. Fiorano's innovative event-driven, dataflow SOA platform integrates applications and complex technologies into an enterprise nervous system, increases business process performance, yields higher message throughput and enhances availability through agent-based visual composition that bridges the capability gap between business models and their implementation - the model is the application, ready to run.

Global leaders including ABN AMRO, Boeing, British Telecom, Chicago Mercantile Exchange Group, McKesson, NASA, POSCO Steel, Qwest Communications, Rabobank, Schlumberger, Lockheed Martin, United States Coast Guard and Vodafone have deployed Fiorano to drive innovation through open, standards-based, dataflow SOA applications built in just days, yielding unprecedented productivity.

Fiorano Enterprise Service Bus (ESB) and Fiorano Message Queue (MQ) deliver the industry fastest, lowest latency, highest throughput real-time messaging (asynchronous and synchronous) to power high performance, highly available, and collaborative workflow applications whose application services are distributed throughout the IT landscape. Fiorano's distributed, peer-to-peer agents' abstract complexity of developing and deploying services to unlock value in a customer's enterprise architecture framework.

To find out more about how Fiorano can help you meet your enterprise integration objectives, visit www.fiorano.com or Email us, we will contact you!

Japan

Japan Germany

Germany